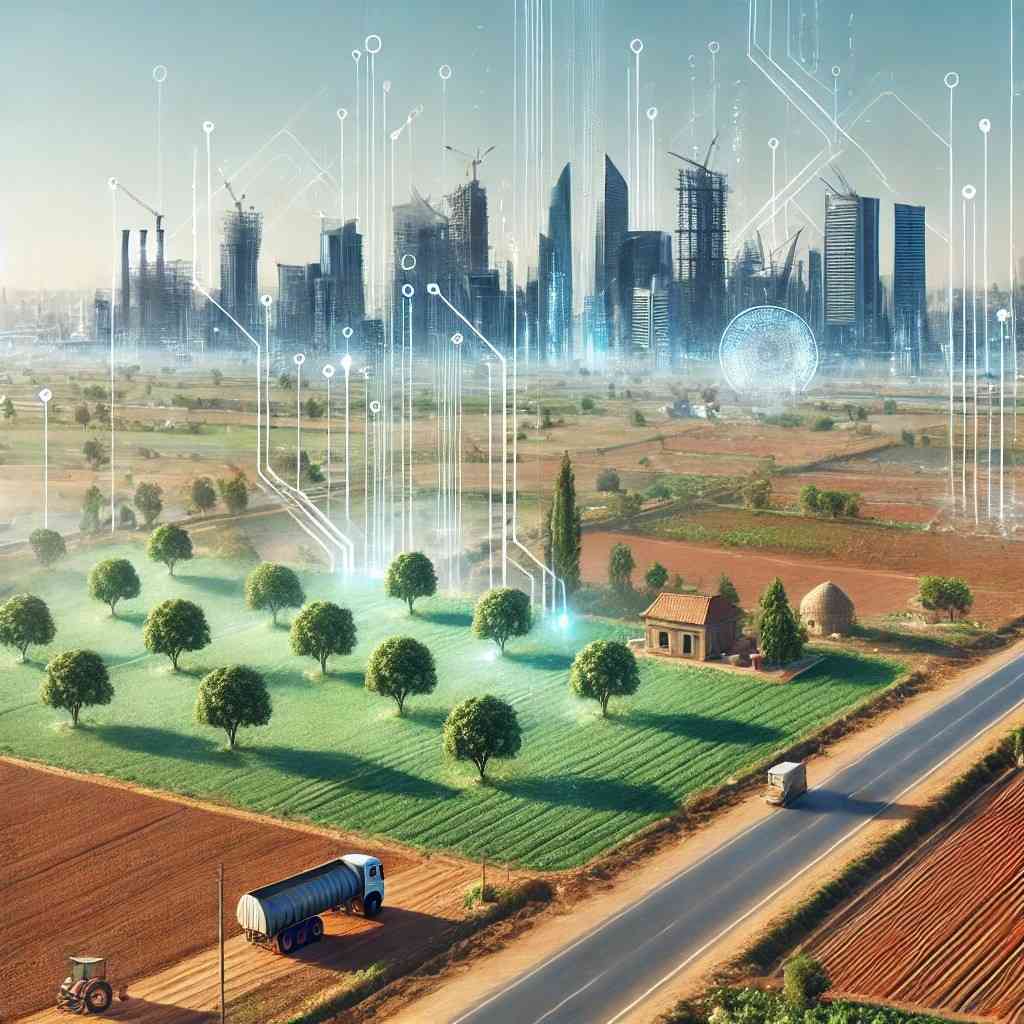

Global events, from pandemics to geopolitical tensions, have underscored the fragility of traditional investment avenues. Stock markets fluctuate, currencies devalue, and inflation erodes purchasing power. In such a scenario, real estate, especially resort properties, stands out as a stable and appreciating asset class.

Why Resort Properties Are Gaining Traction

1. Dual Income Potential

Resort properties offer a unique advantage: the ability to generate rental income while also serving as personal vacation homes. This dual utility ensures consistent cash flow and personal enjoyment.

2. High Appreciation Rates

Tourist destinations, especially emerging ones, witness rapid infrastructure development, leading to significant property value appreciation.

3. Inflation Hedge

Real estate inherently acts as a buffer against inflation. As living costs rise, so do property values and rental incomes, preserving and enhancing your investment's value.

Eko Privilege: Redefining Resort Investments

Eko Privilege, a brand under the esteemed Victorian Corporation, specializes in luxury resort investments across India. Their offerings are about owning property and embracing a lifestyle of opulence and consistent returns.

Key Features:

- Curated Locations: Properties situated in emerging tourist hotspots ensuring high demand.

- Professional Management: End-to-end property management, from maintenance to guest services.

- Transparent Operations: Clear legal and financial frameworks ensuring investor confidence.

Spotlight: Anagha Resort, Rishikesh

Nestled in the serene landscapes of Rishikesh, Anagha Resort epitomizes luxury and tranquility. This award-winning resort offers investors a chance to own a piece of paradise with promising returns.

Highlights:

- Assured Returns: 12% annual returns with bank guarantees.

- Complimentary Stays: Enjoy 10 to 25 nights of free luxury holidays annually.�

- Event Hosting: Facilities to host grand events, adding another revenue stream.

- Wellness Amenities: Yoga decks, meditation zones, and organic dining options

Making the Right Investment Choice

When considering resort property investments:

- Research the Location: Ensure it's a growing tourist destination with infrastructure development.

- Understand the Financials: Analyze the return on investment, maintenance costs, and potential appreciation.

- Assess the Developer's Credibility: Choose developers with a proven track record, like Eko Privilege.

- Consider Personal Use: Properties that offer personal vacation opportunities add intrinsic value.

FAQs

They offer tangible assets with dual income potential and act as a hedge against inflation.

Through professional property management and strategic location choices, ensuring high occupancy rates.

Yes, investors often receive complimentary stays annually.

Rental incomes are taxable, but various deductions can be claimed. It's advisable to consult a tax professional.

Visit their official website, explore available projects, and get in touch with their investment advisors.