In a world where financial stability and securing savings are paramount, resort investments emerge as a lucrative avenue. Not only do they offer secure returns, but they also provide a unique opportunity to diversify one's investment portfolio. With the potential for both short-term gains and long-term stability, resort investments stand out as an attractive option for savvy investors. Let's delve into why resort investments can be an excellent strategy for boosting savings:

1. Stable Returns in Tourism :

The tourism industry is resilient, often proving to be recession-resistant. People consistently seek leisure and travel experiences, ensuring a steady stream of revenue for well-managed resorts. This stability translates into secure returns for investors, mitigating the risks associated with more volatile markets.

2. Diversification Benefits:

Diversifying one's investment portfolio is a fundamental principle of risk management. Resort investments offer an opportunity to diversify away from traditional assets such as stocks and bonds. By allocating funds to resorts, investors can spread risk across different sectors, potentially enhancing overall portfolio performance.

3. Tangible Asset:

Unlike stocks or mutual funds, resort investments often involve ownership of tangible assets. This tangible aspect provides a sense of security for investors, knowing that their money is backed by physical property. Whether it's a beachfront villa or a mountain retreat, the intrinsic value of resort properties can act as a buffer against market fluctuations.

4. Income Generation:

Many resort investments offer dual benefits of capital appreciation and income generation. Beyond the potential for property value appreciation over time, resorts can generate rental income from guests. This regular cash flow can supplement savings or be reinvested to compound returns, further bolstering financial stability.

5. Tax Advantages:

Depending on the location and structure of the investment, resort properties may offer various tax advantages. For instance, certain jurisdictions provide tax breaks or incentives to encourage tourism development. Additionally, expenses related to property maintenance and management may be tax-deductible, enhancing overall returns for investors.

6. Luxury Segment Demand:

The luxury segment of the travel industry continues to thrive, driven by affluent travellers seeking exclusive experiences. Investing in upscale resorts catering to this demographic can be particularly lucrative. High-end amenities, personalised services, and premium offerings attract discerning clientele willing to pay a premium, resulting in robust returns for investors.

7. Strategic Location Selection:

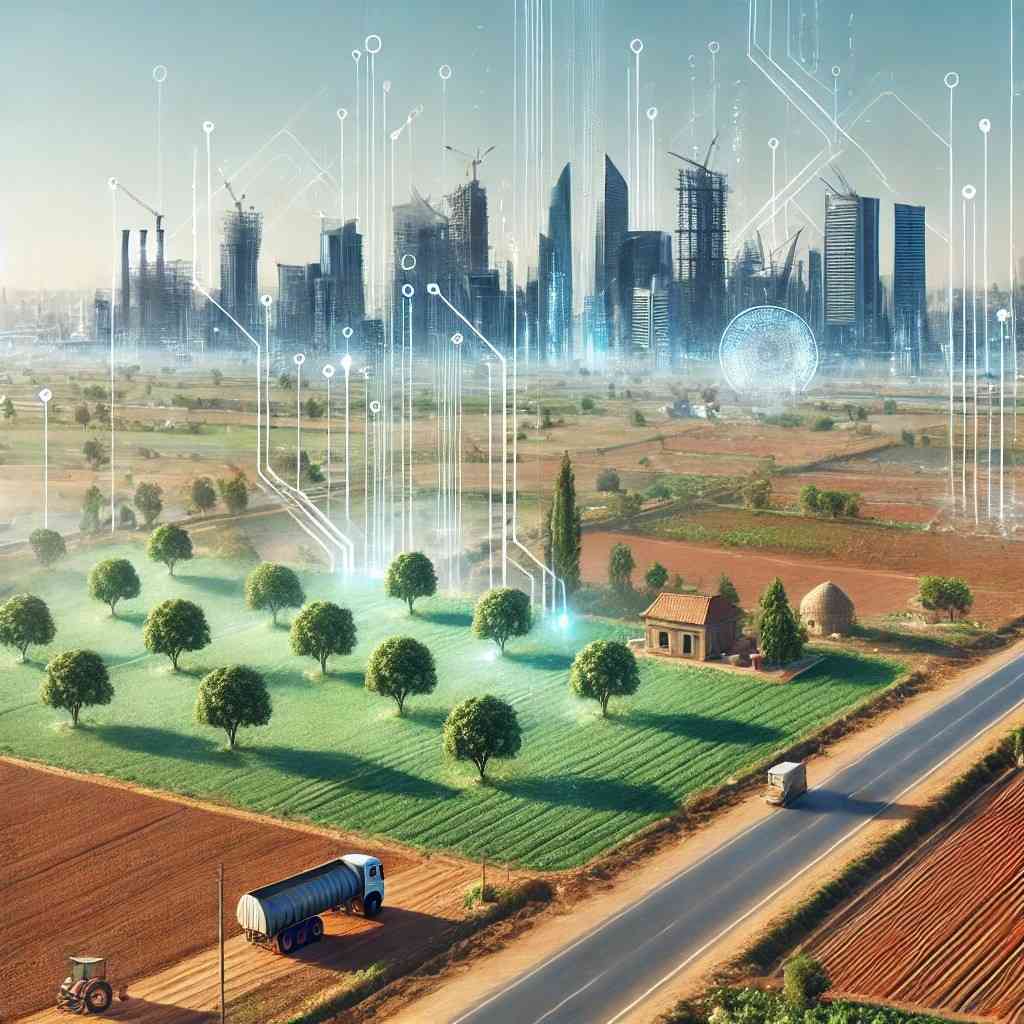

The location of a resort greatly influences its attractiveness to potential guests and investors alike. Investing in resorts situated in prime destinations with high demand can significantly enhance the investment's viability. Factors such as accessibility, natural attractions, cultural heritage, and infrastructure development should be carefully considered when selecting a location for investment.

8. Professional Management:

Opting for resorts managed by reputable hospitality companies or experienced operators is crucial for success. Professional management ensures efficient operations, superior guest experiences, and maximum returns for investors. Additionally, aligning with established brands can enhance the property's visibility, credibility, and long-term value.

9. Adaptability to Market Trends:

Successful resort investments are responsive to evolving market trends and consumer preferences. Incorporating sustainable practices, technology integration, wellness offerings, and experiential elements can position resorts for long-term success. By staying ahead of trends, investors can safeguard their savings and capitalise on emerging opportunities.

10. Risk Mitigation Strategies:

Despite the inherent stability of resort investments, prudent investors should employ risk mitigation strategies. Conducting thorough due diligence, diversifying across multiple properties or locations, maintaining adequate insurance coverage, and staying informed about market dynamics are essential practices for safeguarding investments and maximising savings.

In conclusion, resort investments offer a compelling opportunity to boost savings with secure returns. Through stable income streams, tangible assets, tax advantages, and strategic management, investors can enhance financial stability while diversifying their portfolios. By aligning with market trends, selecting prime locations, and implementing risk mitigation strategies, resort investments can deliver attractive yields and long-term value appreciation. For investors seeking both financial growth and peace of mind, resort investments stand out as a promising avenue to safeguard savings and secure a brighter future.