When it comes to creating wealth, salaried individuals often face a unique challenge: limited time to actively manage investments. Passive income investments provide an excellent opportunity to grow your wealth without demanding constant attention. In this blog, we’ll explore theTop 3 Passive Income Investments tailored for salaried individuals, with a special focus onLucrative Investment Plans in the real estate sector offered byEko Privilege.

Why Passive Income Investments Matter for Salaried Individuals

Passive income allows you to:

- Diversify your income sources beyond your salary.

- Achieve financial freedom and long-term wealth.

- Secure a stable future for your family.

- Build a financial cushion for emergencies or retirement.

Let’s dive into thetop passive income opportunities you can explore today.

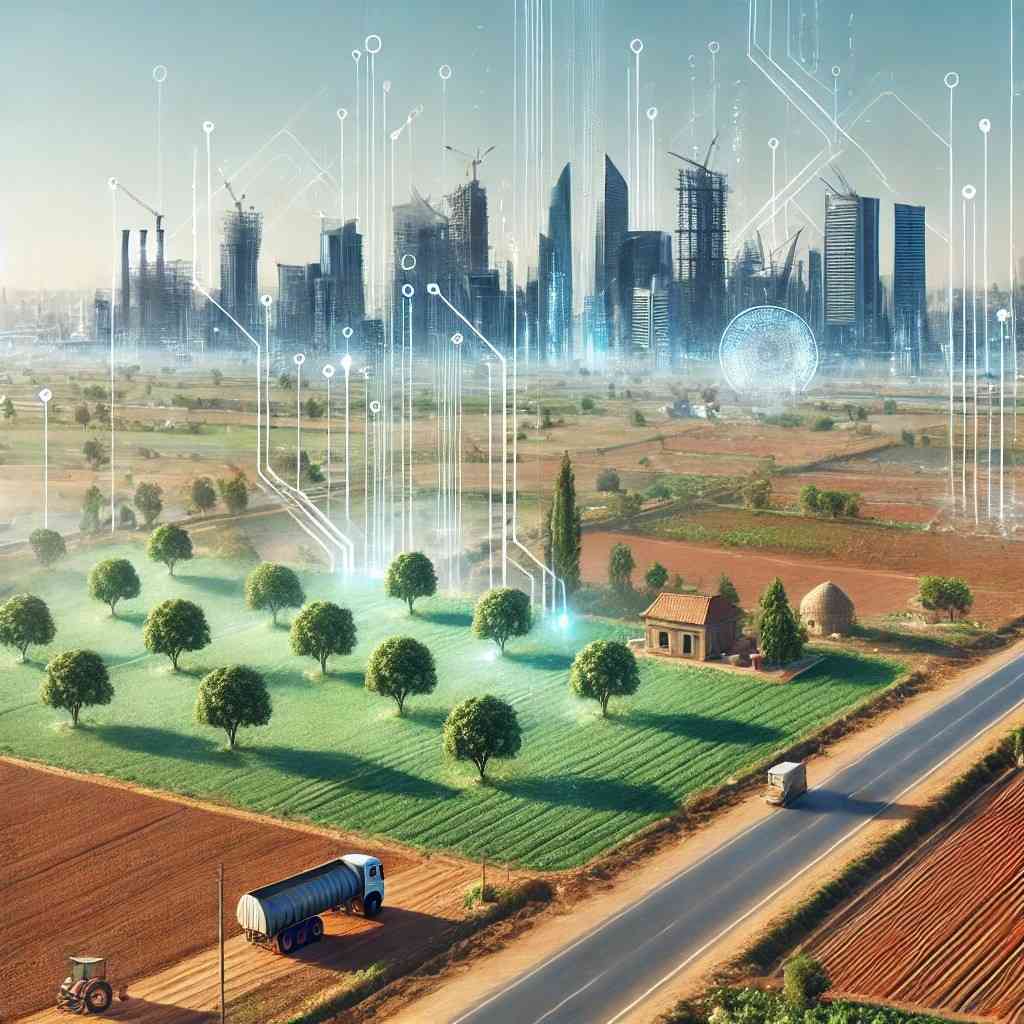

1. Real Estate Investments – Plots and Properties

Why Choose Real Estate for Passive Income?

- Real estate has consistently been one of the most reliable investment options.

- It offers dual benefits: capital appreciation and rental income.

- Properties in prime locations tend to increase in value over time, generating substantial returns.

How Eko Privilege Stands Out

Eko Privilege specializes in offeringluxury plots in high-demand areas like Jim Corbett. TheirLucrative Investment Plans cater to salaried professionals looking for reliable and profitable opportunities.

Passive Income Opportunities in Real Estate

- Luxury Plots: Purchase plots in tourist hotspots or urban areas to earn from appreciation.

- Vacation Rentals: Invest in properties that cater to holidaymakers for year-round rental income.

- Commercial Spaces: Lease commercial properties to generate consistent rental returns.

Benefits of Investing with Eko Privilege

- Prime Locations: Strategic locations ensure high demand.

- Turnkey Solutions: Hassle-free management services.

- Flexible Payment Plans: Making investments more accessible for salaried individuals.

2. Mutual Funds and Index Funds

Why Mutual Funds Are Ideal for Salaried Individuals

- Managed by professional fund managers, mutual funds require minimal involvement.

- They offer diversification, reducing your exposure to market risks.

Types of Mutual Funds to Consider

- Equity Funds: High growth potential; suitable for long-term wealth creation.

- Debt Funds: Lower risk, offering stable returns.

- Balanced Funds: Combine the benefits of equity and debt investments.

Benefits of Index Funds for Passive Income

- Low-cost investment option.

- Tracks market indices, ensuring steady returns over time.

- Ideal for beginners who want to grow their savings passively.

3. Dividend-Yielding Stocks

What Are Dividend Stocks?

Dividend stocks are shares of companies that distribute a portion of their profits to shareholders regularly. These are a popular choice for generating consistent passive income.

Why Dividend Stocks Are a Good Option

- They provide a steady income stream while your capital appreciates.

- Companies with a history of consistent dividends are generally financially stable.

How to Choose the Right Dividend Stocks

- Look for companies withhigh dividend yields (3% or more).

- Invest in industries with stable revenue, like utilities, FMCG, or healthcare.

- Research companies with a long history of dividend payouts.

How to Get Started with Passive Income Investments

1. Define Your Financial Goals

- What are your short-term and long-term objectives?

- Are you investing for additional income or retirement planning?

2. Assess Your Risk Tolerance

- Evaluate how much risk you’re comfortable taking.

- Real estate typically involves lower risks compared to stocks.

3. Research Thoroughly

- Conduct due diligence before committing to any investment.

- Work with trusted partners likeEko Privilege to ensure secure investments.

4. Start Small

- Begin with manageable amounts and scale up as your financial confidence grows.

5. Monitor and Adjust

- Passive income investments still require occasional monitoring.

- Adjust your portfolio to align with changing market conditions or personal goals.

Advantages of Passive Income for Salaried Individuals

- Time-Efficient: Minimal active involvement.

- Scalable: Potential to grow income streams over time.

- Financial Security: Provides stability even during uncertain times.

- Tax Benefits: Certain investments offer tax deductions and exemptions.

Common Mistakes to Avoid When Investing

- Ignoring Research: Don’t invest blindly; always verify facts.

- Over-Leveraging: Avoid taking excessive loans for investments.

- Focusing Only on Returns: Consider liquidity, risks, and tax implications.

- Neglecting Diversification: Spread your investments across various assets.

- Delaying Investments: The earlier you start, the better your returns.

Why Choose Eko Privilege for Real Estate Investments?

Eko Privilege offers unique and lucrative opportunities tailored to salaried individuals:

- Expert Guidance: Professional advice to help you make informed decisions.

- Low-Entry Barrier: Affordable plans to help you get started easily.

- Sustainable Growth: Investments in eco-friendly and high-growth areas.

If you’re ready to secure your future with reliable passive income,Eko Privilege is your trusted partner.

FAQs About Passive Income Investments

- What is passive income?

Passive income is earnings generated with minimal active involvement, such as rental income or dividends. - Which passive income investment is best for salaried individuals?

Real estate, mutual funds, and dividend-yielding stocks are ideal for salaried individuals. - What are lucrative investment plans in real estate?

These include investing in luxury plots, rental properties, and commercial spaces in high-demand locations. - How can real estate generate passive income?

Real estate generates income through property rentals and long-term value appreciation. - Is it safe to invest in luxury plots?

Yes, especially when investing with reputable companies likeEko Privilege, which offer secure and well-located options. - What is the minimum investment required for real estate?

The minimum investment varies, but companies likeEko Privilege offer flexible payment plans. - Are mutual funds better than real estate?

Both have their pros and cons; mutual funds offer liquidity, while real estate provides stable, long-term returns. - How do dividend stocks work?

Companies distribute a portion of their profits as dividends to shareholders, creating a passive income stream. - What are the risks associated with passive income investments?

Risks include market volatility, property depreciation, and mismanagement. Proper research can mitigate these risks. - How do I choose the right passive income investment?

Assess your financial goals, risk tolerance, and available capital before choosing an investment plan.