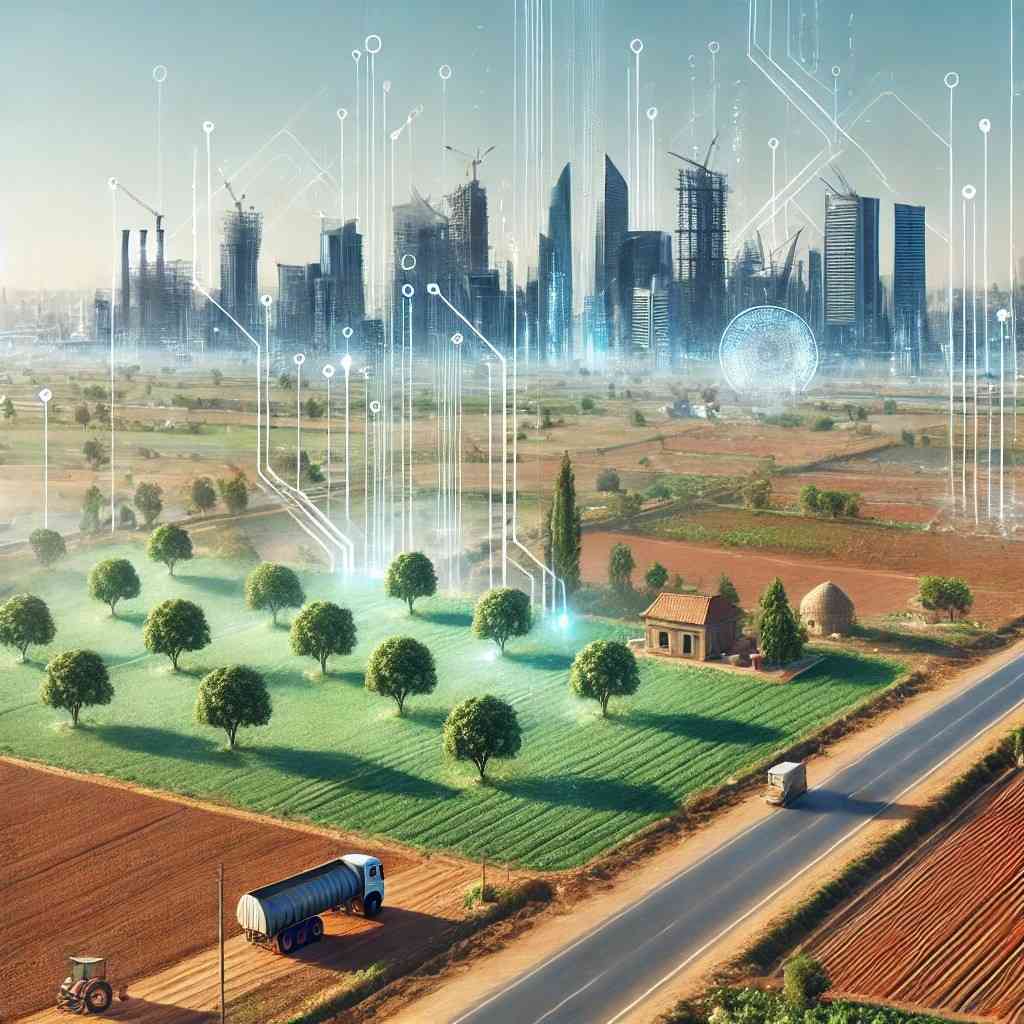

The Real Estate market has always been one of the most reliable and profitable investment routes, for those looking for stability, growth, and long-term returns. Investing in Real Estate can be a smart choice. In India, the real estate market offers many opportunities that cater to various investment objectives. Whether you are a new investor or an experienced professional, this real estate investing guide will provide valuable information to help you make informed decisions.

Types of Real Estate Investments in India

The Indian Real Estate market is vast and diverse. Here are the main types of investments you can consider:

1. Residential Properties

This is because residential real estate is considered the most popular investment option. These include apartments, villas, and land. Locations are close to major cities. Educational centers And industrial areas are especially attractive because of the constant room demand.

2. Commercial Properties

Commercial spaces such as desk buildings, retail trade shops, and storehouses are ideal for wine investors looking for a stable income stream. As companies expand, the demand for business increases. Especially in metropolitan areas like Bengaluru, Mumbai, and Delhi NCR.

3. Investing in Land

Buying land is one of the oldest forms of real estate investment. It is a low-holding option with significant appreciation potential. Places close to future infrastructure projects or tourist destinations such as Jim Corbett in Uttarakhand are excellent schools.

4. Cottages and luxury Retreats

With the increase in resorts and ecotourism. Investing in event space has become a profitable trend. Destinations like Eko Privilege at Jim Corbett offer a combination of natural beauty and luxurious amenities. This makes us a preferential choice for investors.

Steps to Get Started with Real Estate Investment

Follow these steps to ensure a successful investment.

1. Set your Goals

Before you dive Decide if you are looking for short-term rental income. Increasing the value of long-term capital or a mix of both Your goals will determine your investment strategy.

2. Choose the Correct Location.

Location is an important factor in real estate investing. Look for areas with upcoming infrastructure projects. Connecting to the main hub For example, destinations like Jim Corbett are gaining traction because of their unique natural beauty and modern conveniences.

3. Study Market Trends

Follow the latest news on real estate market trends, government policies, and economic indicators. This information will help you determine the best time to invest.

4. Set a Budget

Create a clear budget that includes property costs, registration fees, and maintenance costs. and other expenses Ensure access to funding as needed.

5. Verification of Legal Documents

To avoid disputes Please check the property title, RERA registration, and other legal documents. Work with trusted developers or brokers to ensure transparency.

6. Evaluate ROI potential

Estimate rental income increased value and overall return on investment Features like Eko Privilege in Jim Corbett often guarantee a combination of ROI and lifestyle benefits.

Why Eko Privilege Stands Out

If you are looking for a unique investment opportunity,Eko Privilege in Jim Corbett, Uttarakhand is worth exploring. Here's why:

Ideal Location: Set next to the greenery of Jim Corbett National Park, this eco-privilege offers breathtaking views and proximity to nature.

Luxurious Amenities: The property has modern amenities such as swimming pools, banquet halls, and entertainment venues. Providing a premium living experience.

Sustainable Living: Eko Privilege focuses on environmentally friendly development. This makes it the perfect choice for conscious investors.

High ROI: With the growing popularity of ecotourism and Jim Corbett's status as a hotspot, Properties here therefore generate excellent rental income and appreciation potential...

Customizable options: Whether you are looking for a vacation home, villa, or land, Eko Privilege offers a solution tailored to your needs.

Tips for First-Time Real Estate Investors

Start Small: Start with accessible assets to gain experience and confidence.

Focus on Growth Areas:Invest in regions with future growth potential. Instead of a saturated market

Consulting Experts: Work with a real estate consultant, broker, or company promoter, like RR Property, who is known for their transparency and expertise.

Diversify your Investments: Spread your investments across different property types and locations. To reduce or risk

Be Patient: Real estate investing takes time to generate returns, however, you are likely long-term.

Investing in real estate today is a combination of careful planning. Marketing knowledge and strategic decisions India's diverse real estate market offers opportunities to all types of investors. From luxury residences in tourist destinations to commercial areas in the city center

If you are looking for a combination of tranquility, luxury, and high returns,EkoPrivilege is a great choice. With a proven history and commitment to excellence, Eko Privilege guarantees a rewarding investment experience. Fulfill your real estate dreams with our complete real estate investment guide to guide you!

Contact us todayto explore premium opportunities with Eko Privilege.

FAQS- Real Estate Investment in India

1. What is the best type of real estate investment for beginners in India?

Beginners often find it easier to invest in residential real estate such as apartments or land. This is due to higher management costs and consistent demand.

2. Why is location important in real estate investing?

Location affects property value. wastewater and the potential to increase Areas with growing infrastructure such as Jim Corbett or ecotourism will give better returns

3. What is RERA and why is it important?

RERA stands for Real Estate Regulatory Authority. Guaranteed transparency Transaction control and protect buyers By making developers responsible

4. How can I guarantee that a property is legally clean before purchasing?

Verify property ownership Ensure that it is registered under RERA and verify the existence of tax certificate. It is recommended to consult a legal expert.

5. What is the average return on investment (ROI) for real estate in India?

ROI varies by location and type of ownership. This usually varies from 5% to 12% per year. Properties in popular tourist destinations like Jim Corbett can offer higher returns.

6. How do I finance my real estate investment?

Financing is possible through reserve funds and bank loans. Partnership It is essential to have an appointment and a clear repayment plan in place before proceeding.

7. Is investing in land a good idea in India?

However, investing in land is often considered profitable due to its potential for appreciation. Especially in areas near future investment or tourist attractions.